Overview

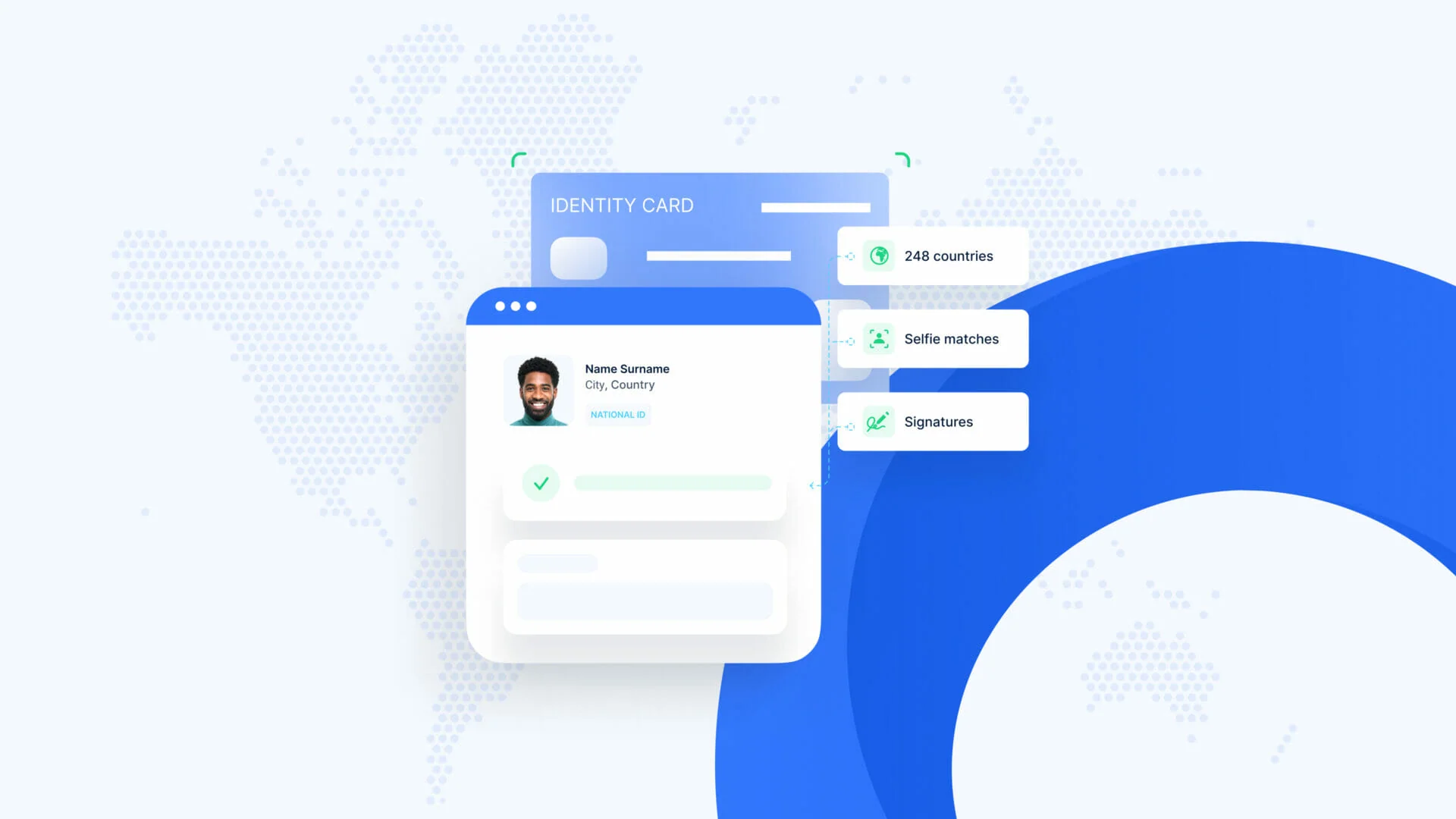

KYC (Know Your Customer) is a critical feature for ensuring compliance and security on a cryptocurrency exchange. My goal was to redesign the KYC process to enhance usability, reduce drop-off rates, and tailor the experience for specific regional requirements such as Singapore and Japan.

1. Empathize

Understanding User Pain Points

Through user research and analyzing platform metrics, I identified key issues with the existing KYC process:

Complex User Flow: Users were required to verify all information (Identity, Address, etc.) in one continuous process, leading to confusion and frustration.

High Drop-Off Rates: A significant number of users abandoned the process at Steps 1 and 2.

Customer Support Overload: Frequent user inquiries about the KYC process created significant pressure on support teams.

Regional Barriers: The lack of region-specific solutions, such as Singapore’s Singpass integration, hindered smooth verification for local users.

2. Define

Problem Statement

How might we redesign the KYC process to reduce user drop-off rates, streamline verification, and provide a regionally tailored experience?

Goals

User Goals: Simplify the KYC process, provide clear progress indicators, and ensure secure data handling.

Business Goals: Increase verification completion rates, reduce support inquiries, and enhance user retention.

3. Ideate

Solution Ideation

Based on user insights, I proposed:

1. A 3-Step KYC Process:

Separate verification into distinct steps (e.g., Identity, Address).

Provide partial permissions for each completed step, encouraging users to progress further.

2. Regional Customization:

Integrate Singpass for Singaporean users to streamline verification.

3. Improved Information Architecture:

Design a more intuitive UI with clear progress tracking and instructions.

4. Design

User Flow

I mapped out a new user journey for the KYC process, showing clear entry and exit points for each step.

Information Architecture

Reorganized the KYC process into a logical structure to reduce cognitive load.

Wireframes

Low-Fidelity Wireframes

Initial sketches to visualize the 3-step KYC process and improved UI layout.

5. Prototype & Test

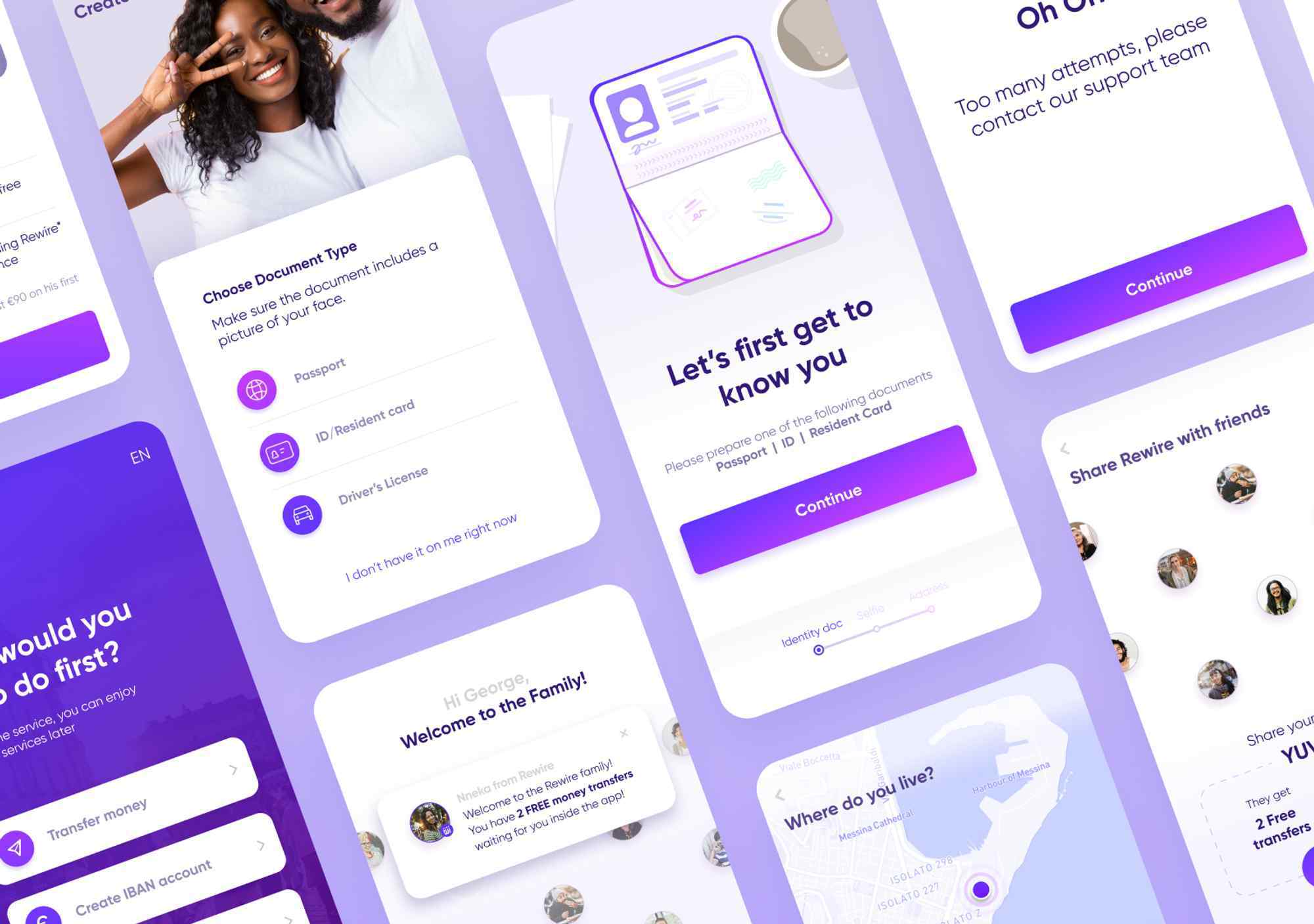

High-Fidelity Wireframes

Final designs showcasing:

Step-by-step verification progress.

Singpass integration for Singaporean users.

Streamlined UI for all user types.

Usability Testing

Tasks:

Complete Step 1 of the KYC process (Identity verification).

Check progress and permissions after completing Step 2 (Address verification).

Use Singpass to complete verification for Singaporean users.

Key Insights:

Clear Progress Indicators: Users appreciated the breakdown of steps and found it easier to track their progress.

Reduced Cognitive Load: Simplified instructions led to faster completion times.

Positive Feedback on Singpass Integration: Local users completed the process 50% faster.

6. Results

Impact Metrics

35% Increase in Completion Rates: More users completed the KYC process.

40% Reduction in Support Requests: Clearer instructions and progress tracking eased user confusion.

25% Increase in User Retention: A more intuitive experience encouraged users to stay on the platform.

50% Faster Verification Time: Singpass integration improved efficiency for Singaporean users.

7. Reflection

What Worked Well

Splitting the process into three steps reduced user overwhelm.

Regional customization, such as Singpass, demonstrated the importance of localized solutions.

Lessons Learned

Clear communication and progress tracking are essential for complex processes.

Regional nuances should be considered in the early stages of design.