Overview

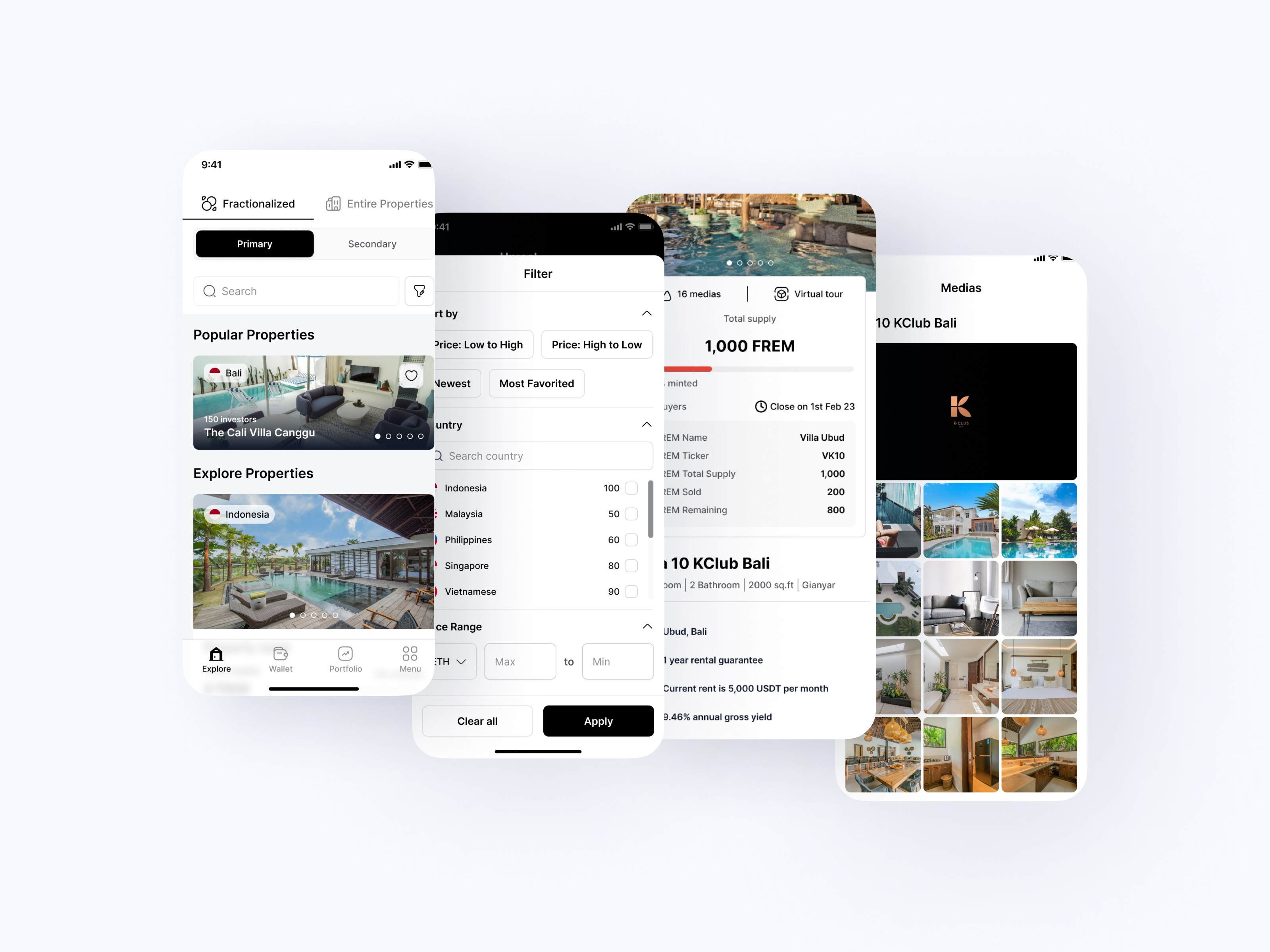

This project aimed to design a lending and borrowing feature for a cryptocurrency platform, focusing on shifting user behavior from traditional savings methods (banks and e-wallets) to crypto-based savings. The solution targeted both non-tech and high-tech users, emphasizing accessibility, flexibility, and security.

1. Empathize

Understanding User Challenges

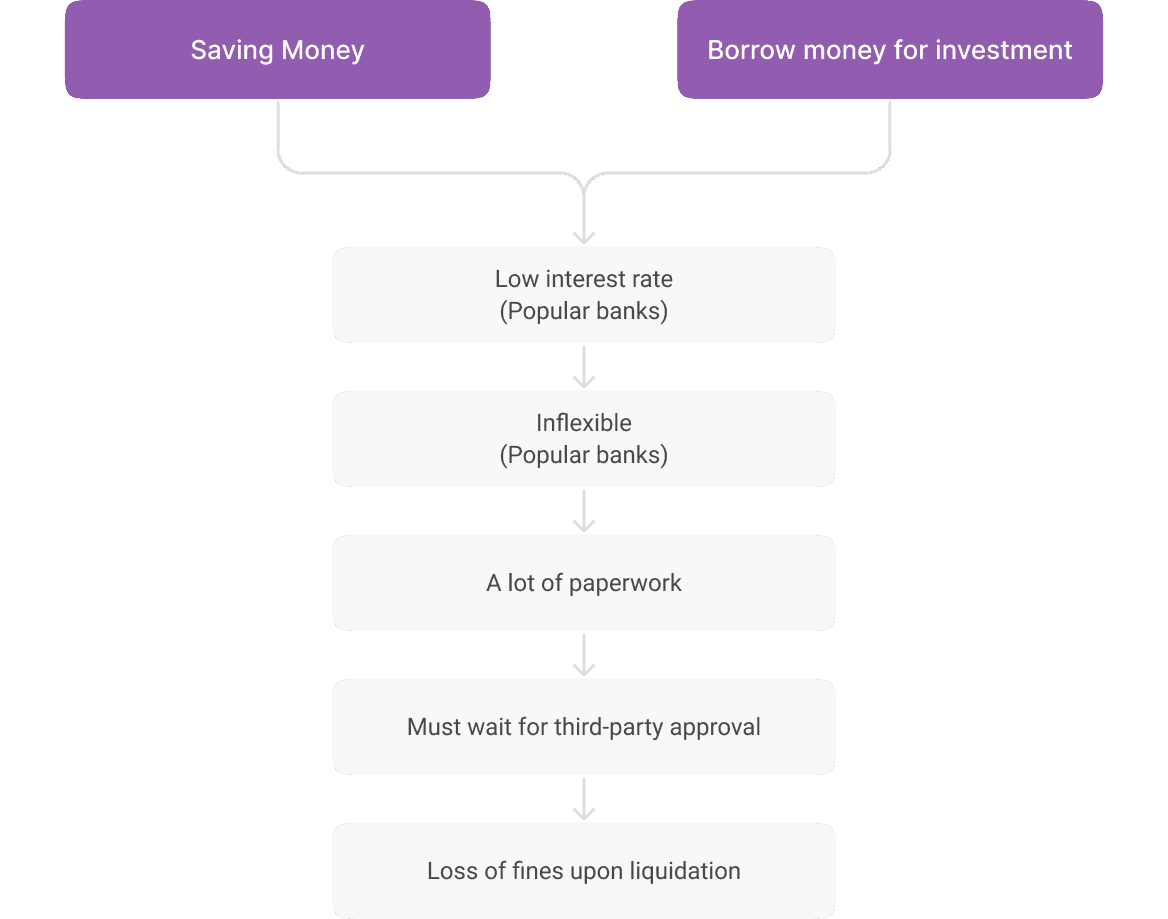

Through user research and market analysis, I identified key challenges:

Mindset Shift: Users were hesitant to adopt crypto savings, preferring familiar options like banks and e-wallets.

Non-Tech Barriers: Many potential users had no prior knowledge of cryptocurrency, creating a steep learning curve.

Trust Issues: Concerns about security, pool liquidity, and privacy were significant deterrents.

Flexibility Expectations: Users valued flexibility in deposits, withdrawals, and the lack of personal data requirements.

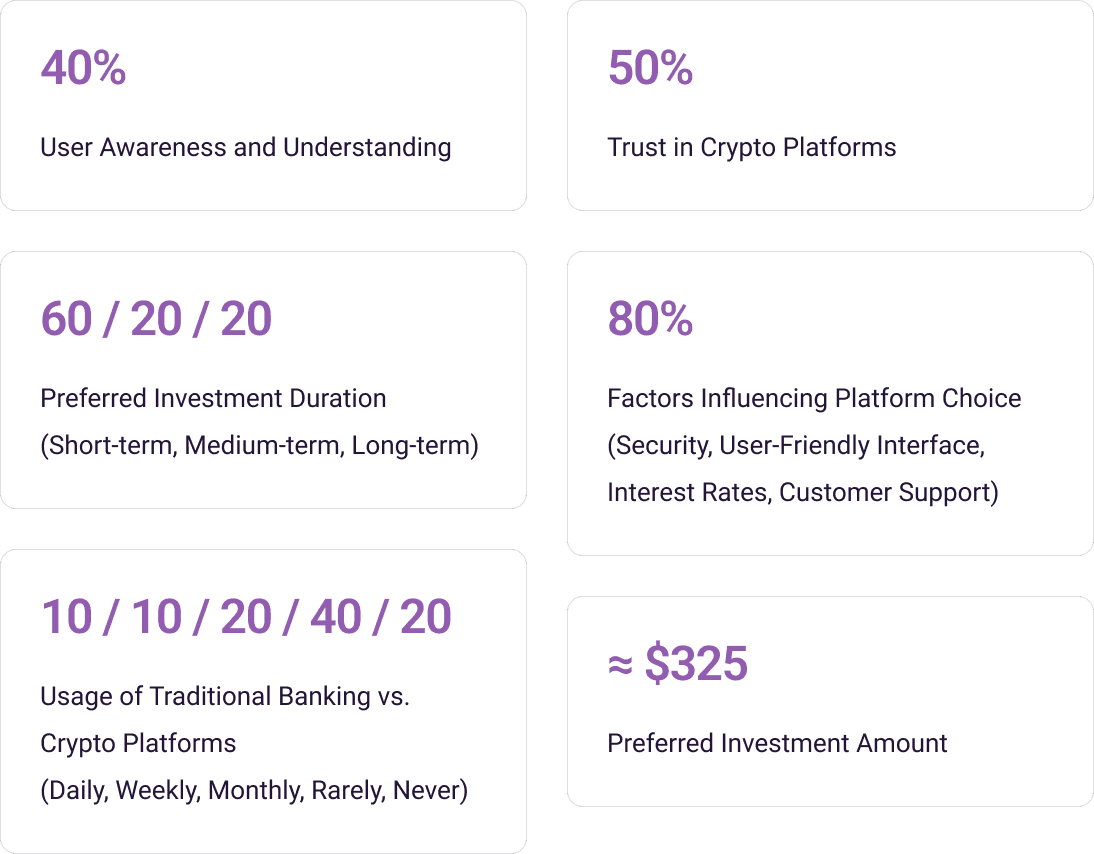

User Research Insights

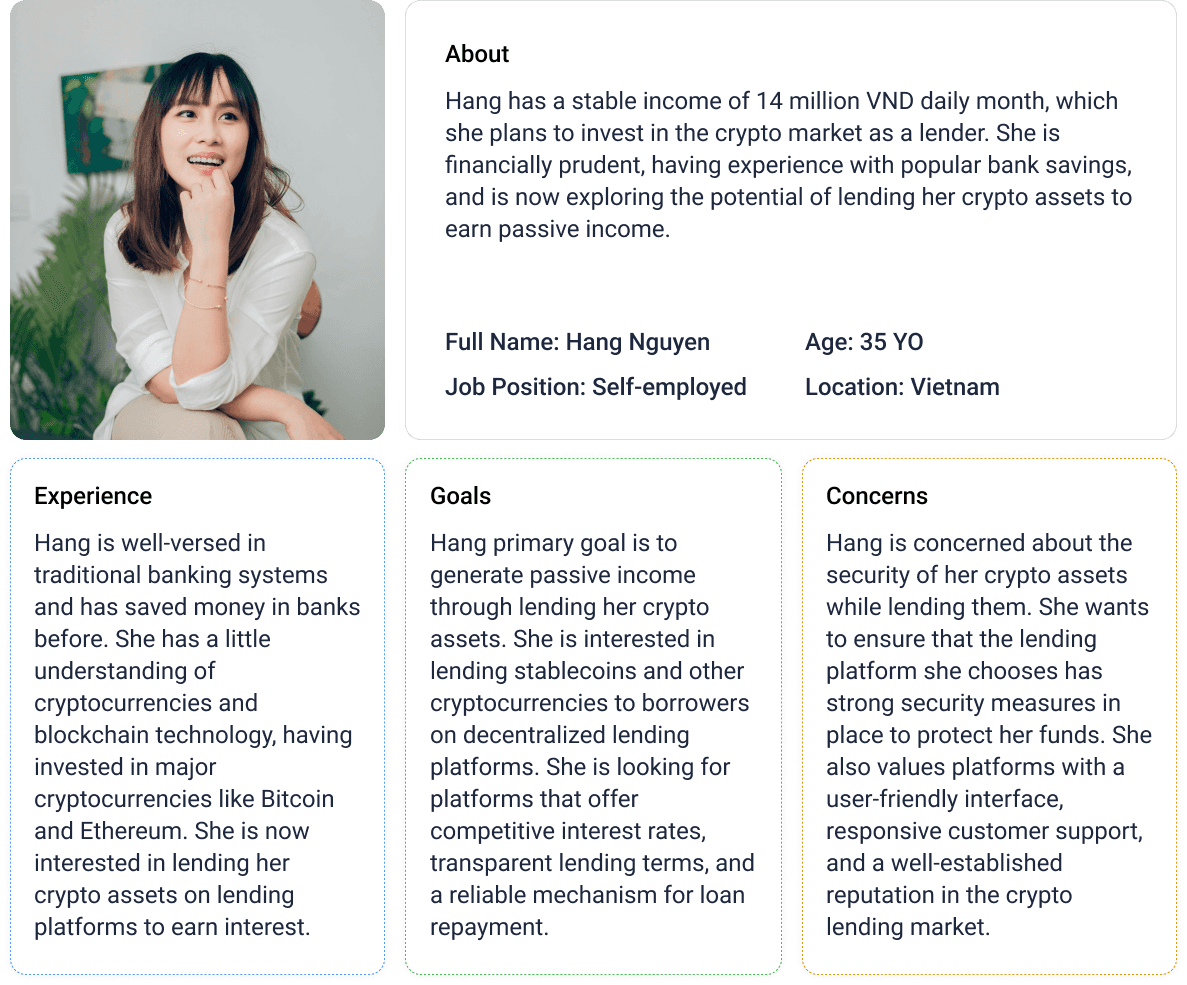

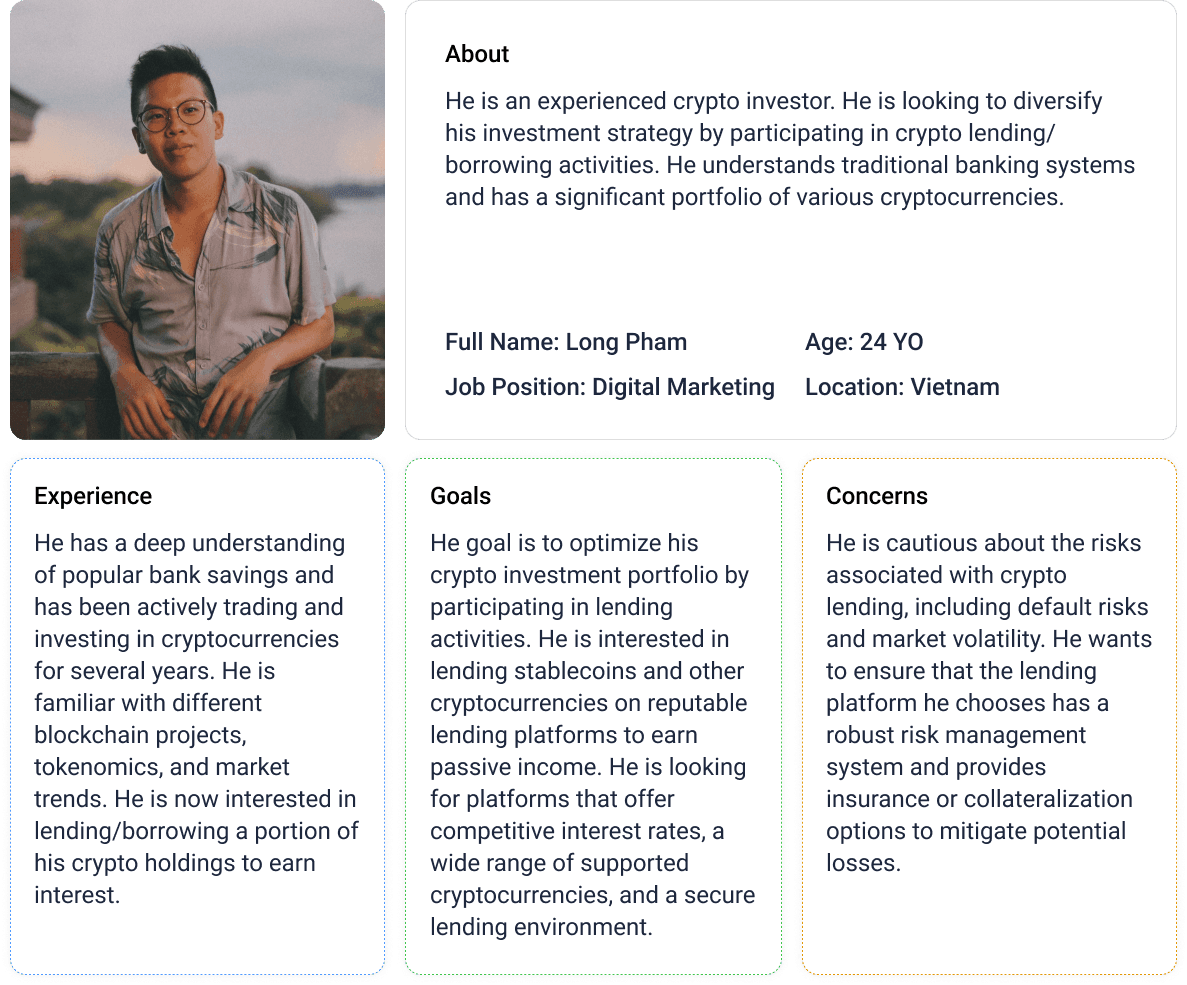

I conducted interviews and surveys with two key user groups:

Non-Tech Users: Users unfamiliar with cryptocurrency and hesitant to adopt it.

High-Tech Users: Crypto-savvy individuals seeking advanced features.

Key Pain Points

Lack of understanding of crypto savings benefits.

Perception of complexity in using crypto platforms.

Security and trust concerns around asset safety and personal data privacy.

2. Define

Problem Statement

How might we design a crypto-based lending and borrowing feature that is simple and trustworthy for non-tech users while providing advanced options for high-tech users?

Goals

User Goals: Enable secure, easy-to-use crypto savings with attractive interest rates, flexible access, and minimal barriers.

Business Goals: Increase adoption of the crypto savings feature, enhance user retention, and build trust in the platform.

3. Ideate

Solution Ideation

Based on research, I proposed the following:

1. Guided Onboarding for Non-Tech Users:

Step-by-step tutorials explaining crypto savings.

Clear visual indicators and language-free icons.

2. Advanced Options for High-Tech Users:

Detailed analytics on interest rates, pool liquidity, and asset performance.

Customizable deposit and withdrawal schedules.

3. Security and Trust Enhancements:

Highlight encryption and privacy measures prominently.

Real-time updates on pool liquidity and transaction safety.

4. Design

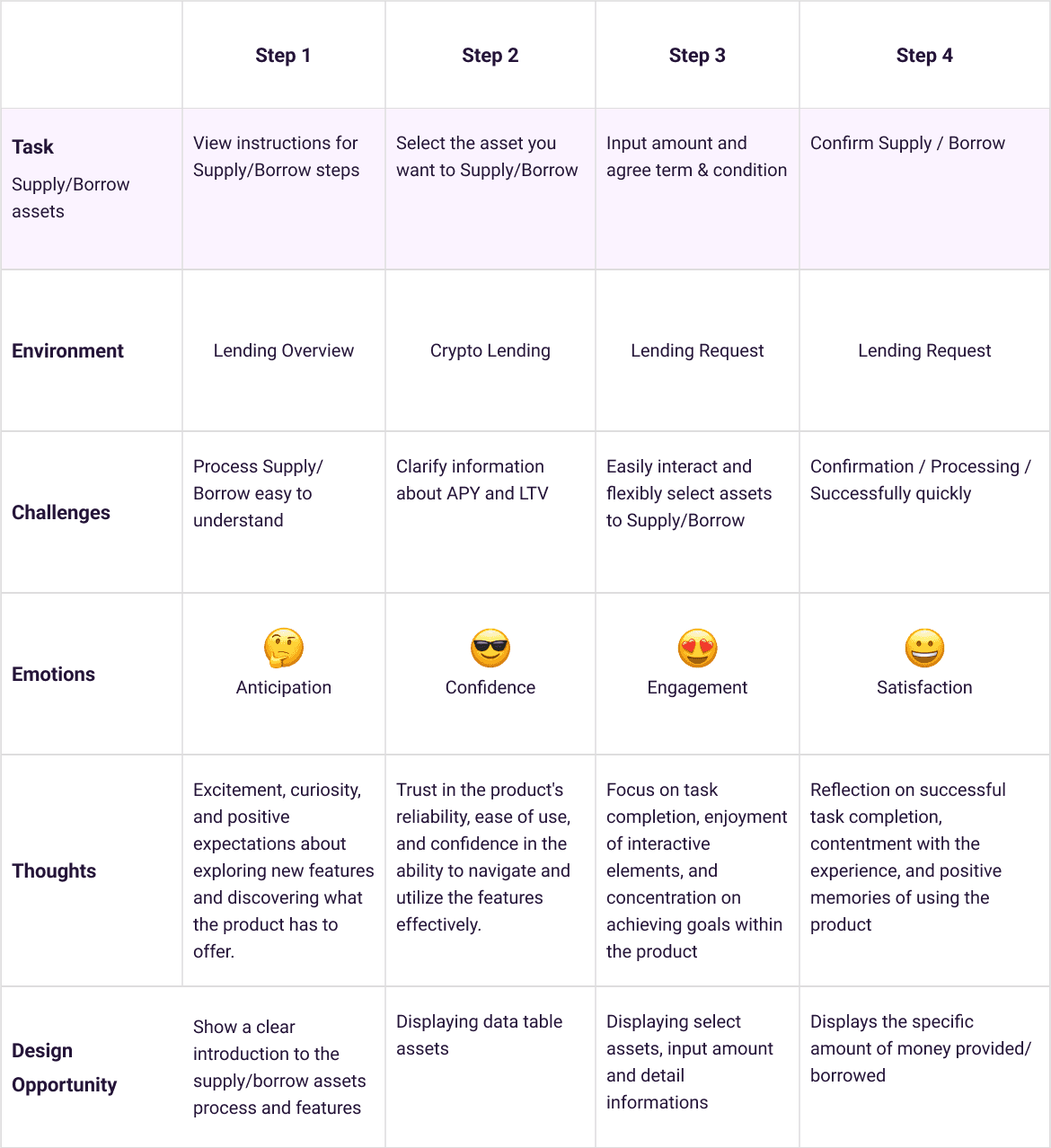

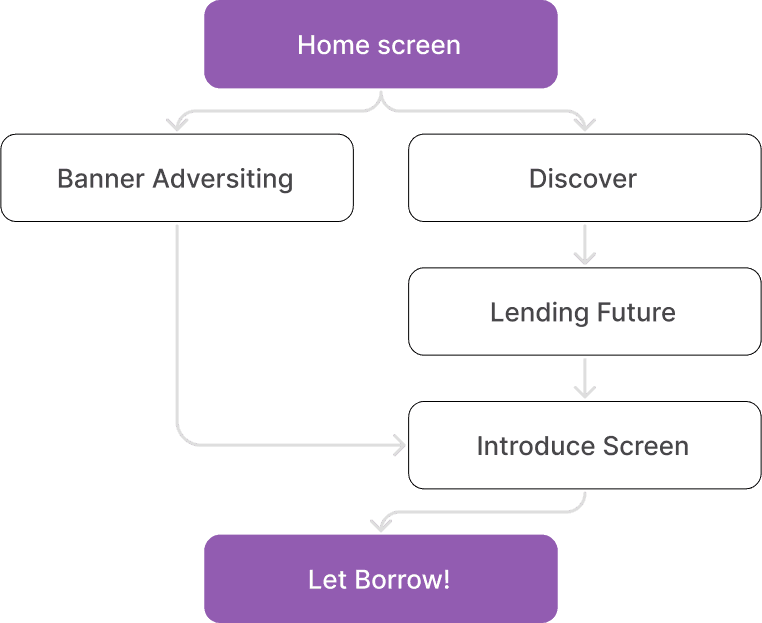

Task Mapping

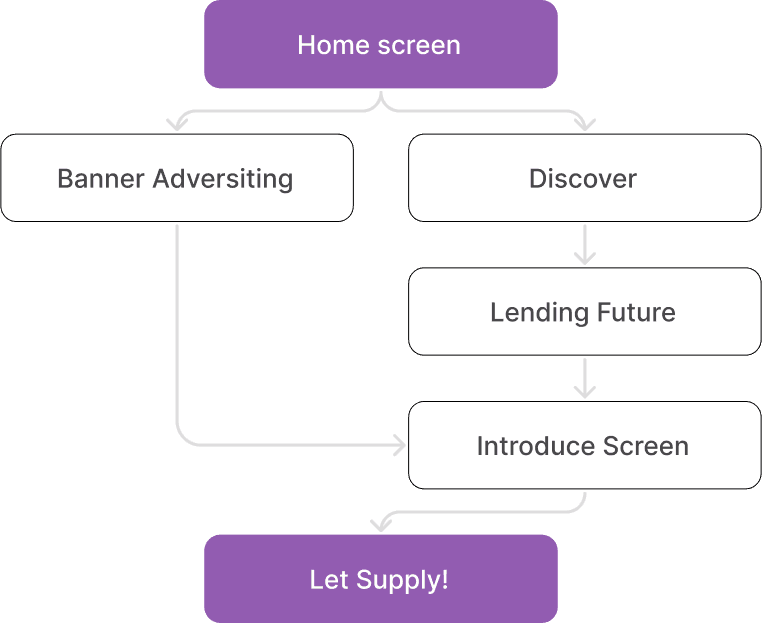

User Flow

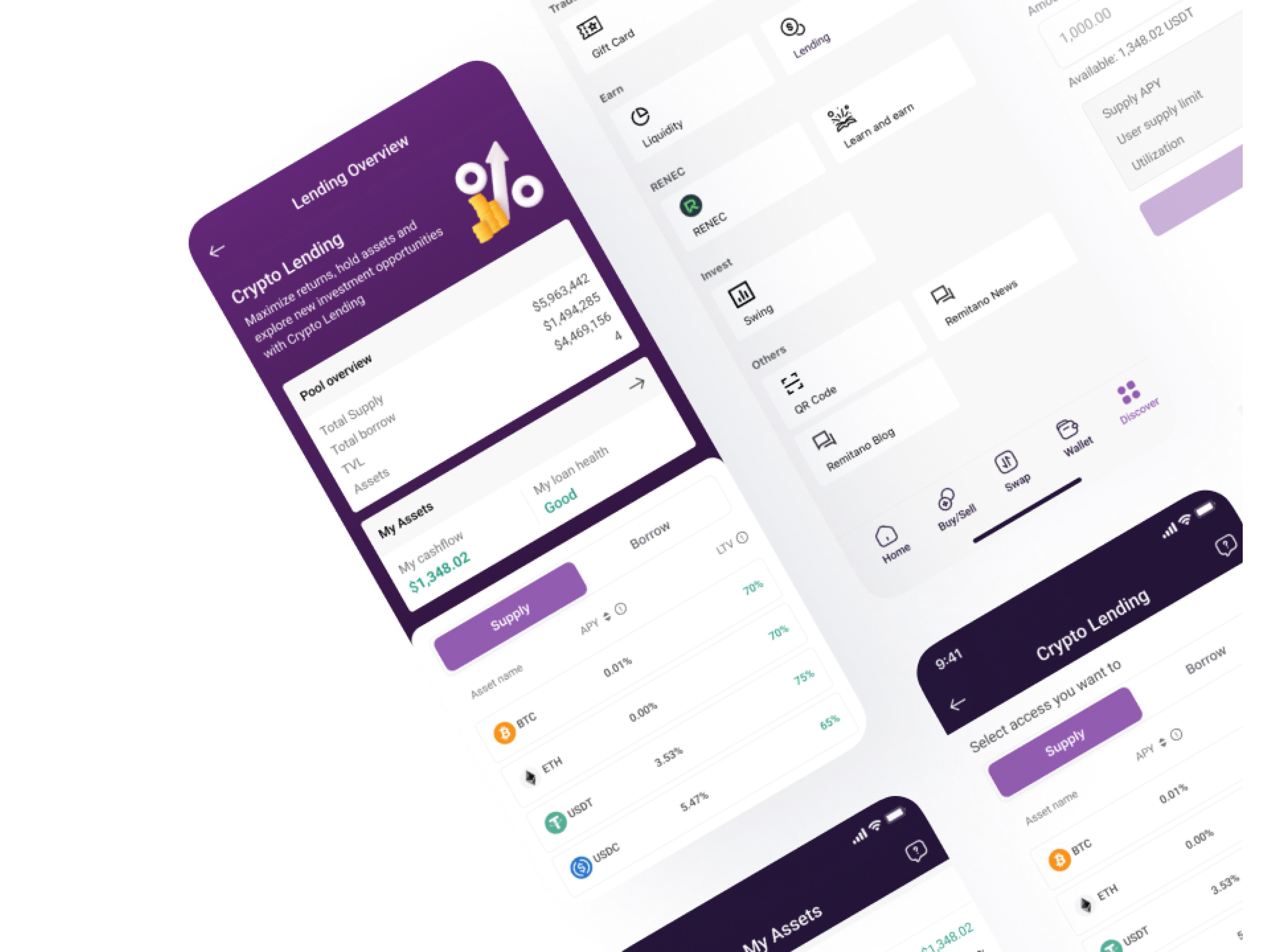

I designed separate user flows for:

First-time non-tech users.

Experienced high-tech users navigating advanced features.

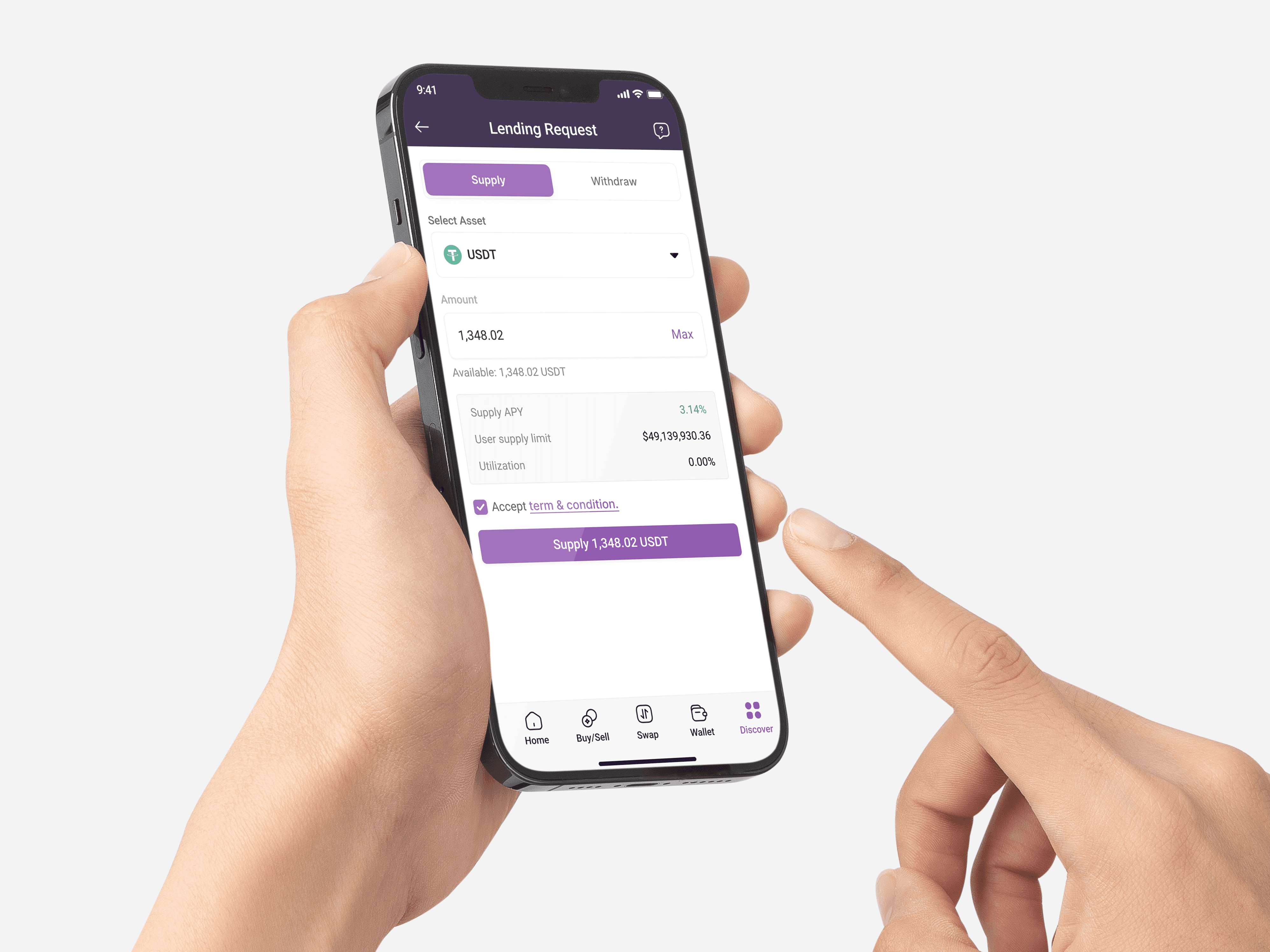

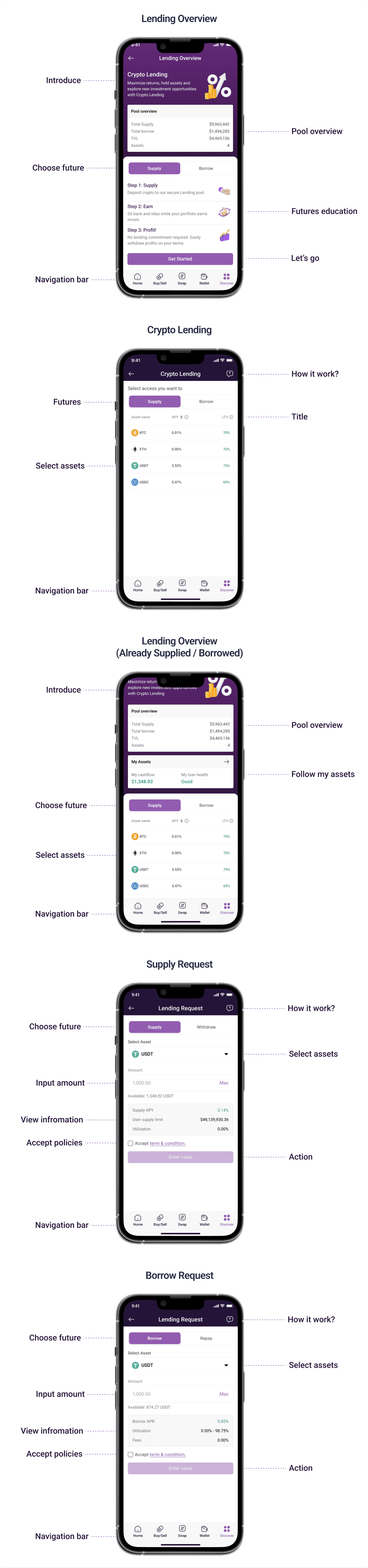

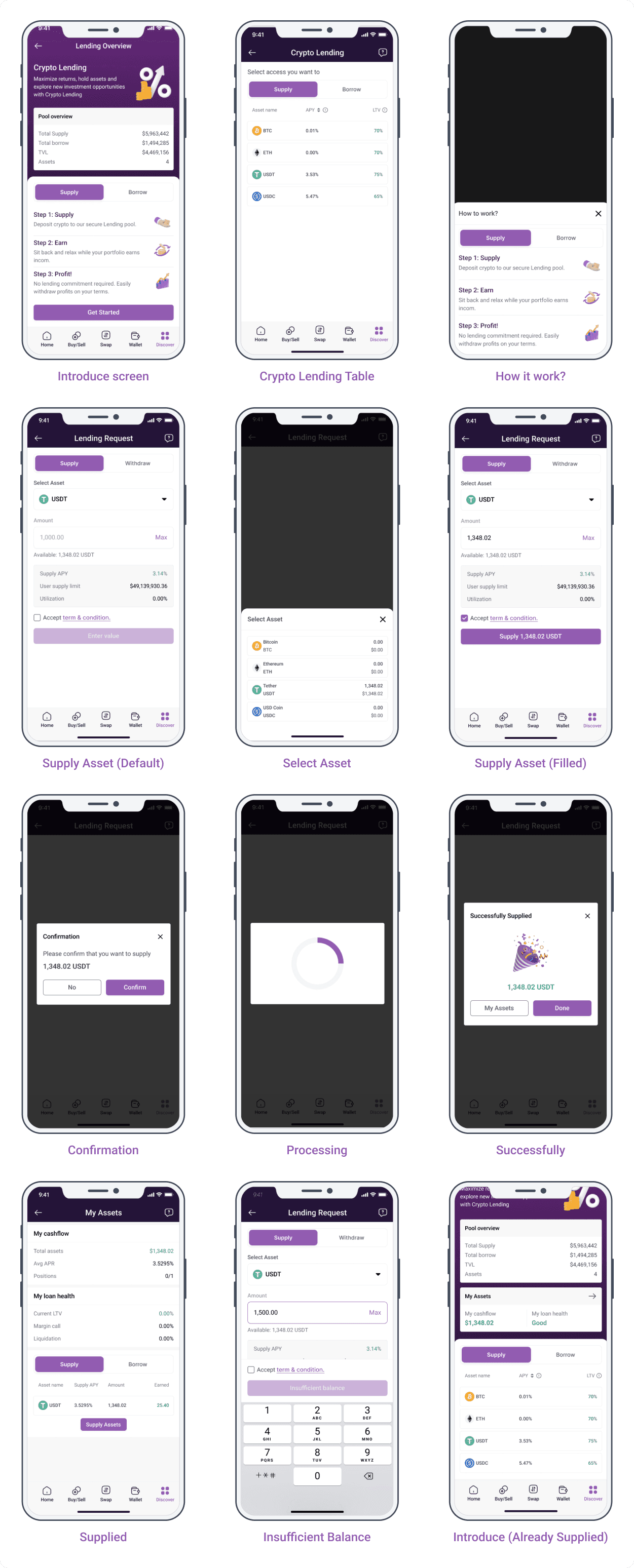

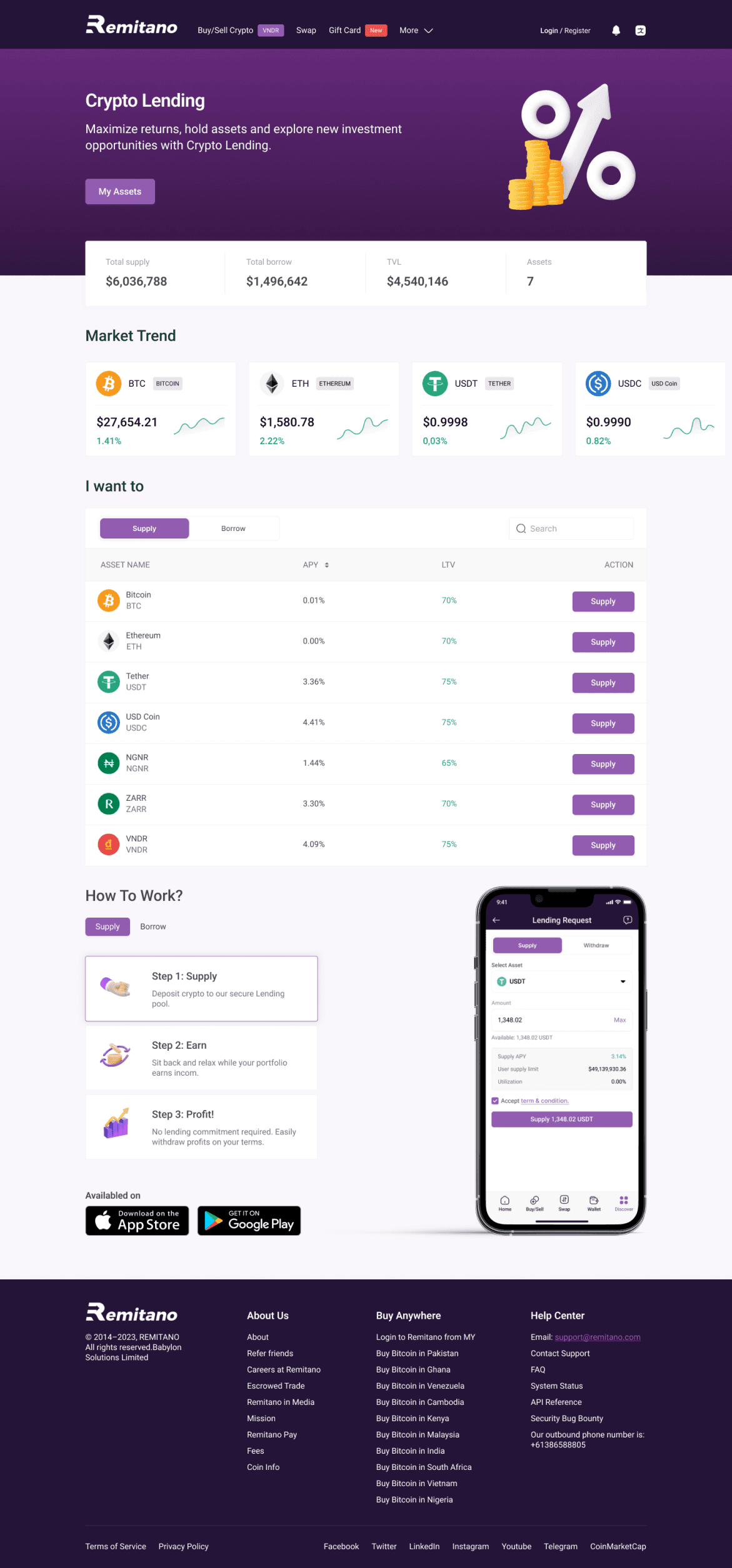

Supply

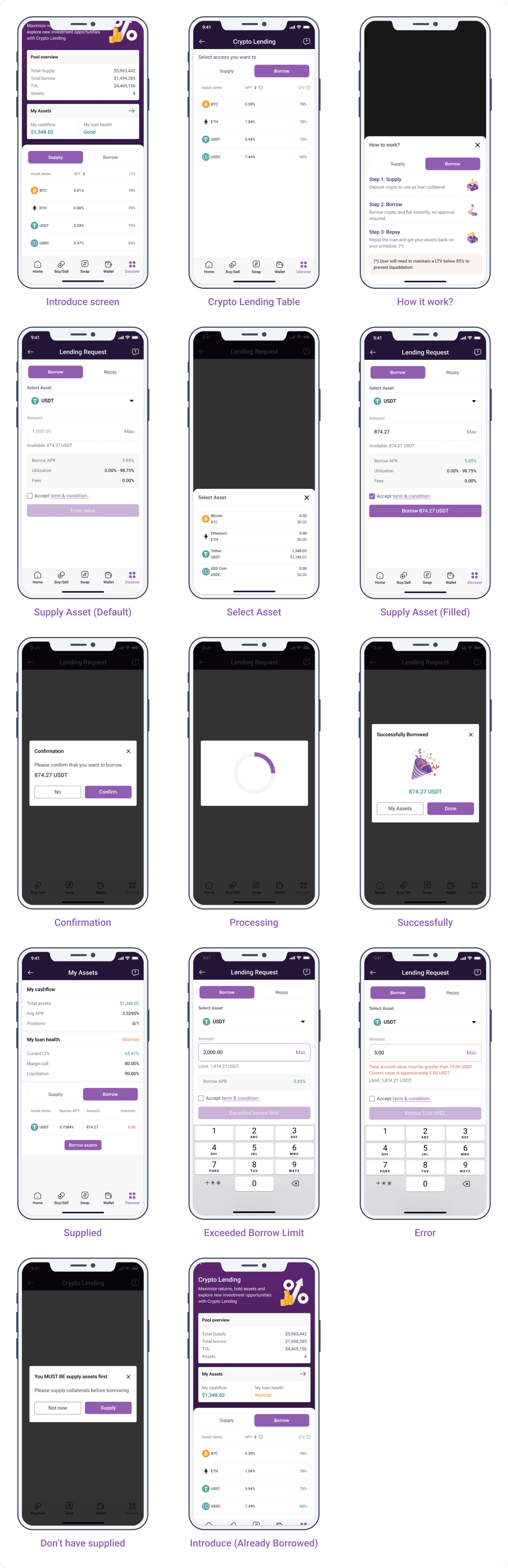

Borrow

Information Architecture

Reorganized the platform’s structure to include clear sections for onboarding, saving options, and transaction tracking.

5. Prototype & Test

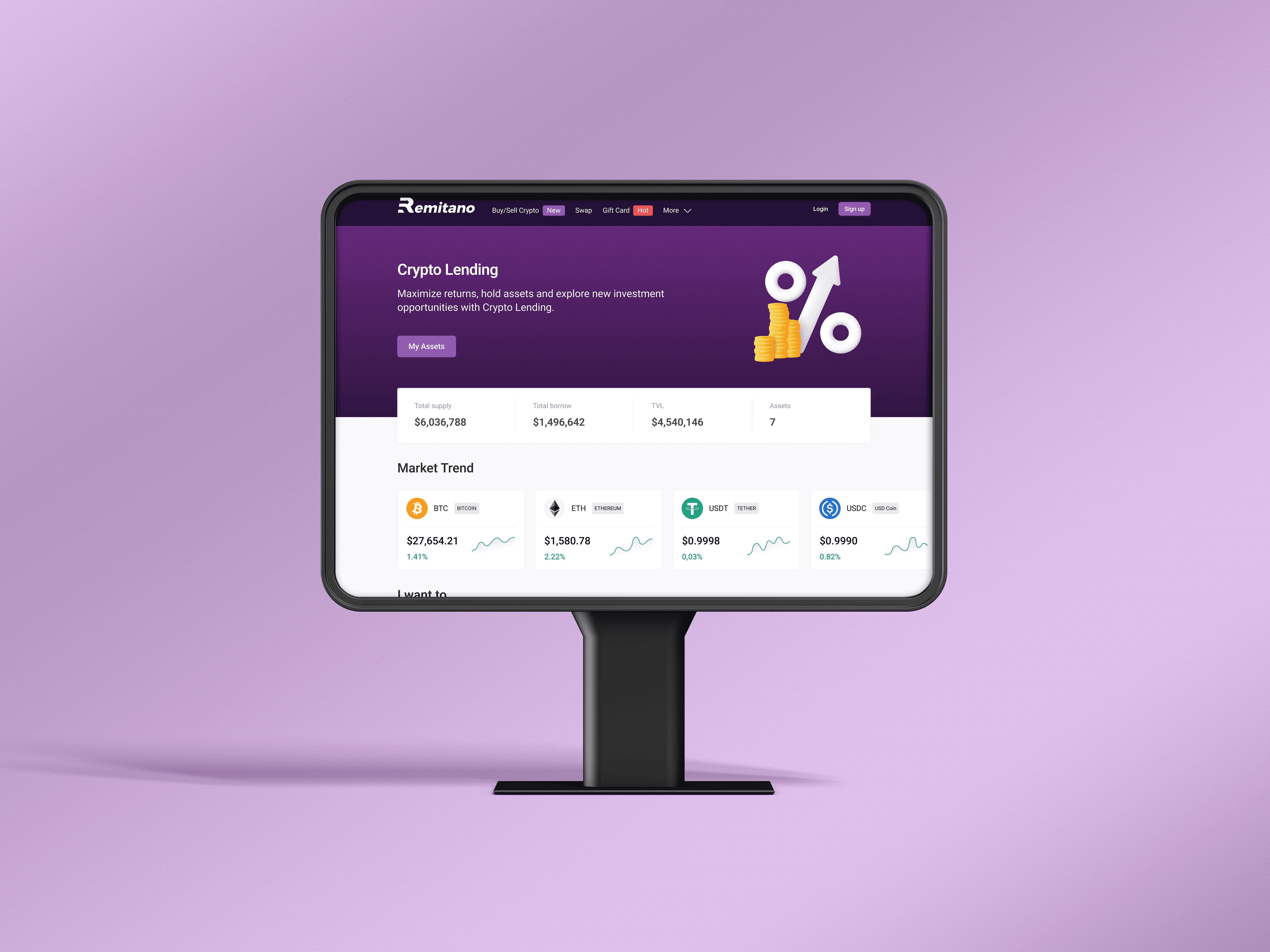

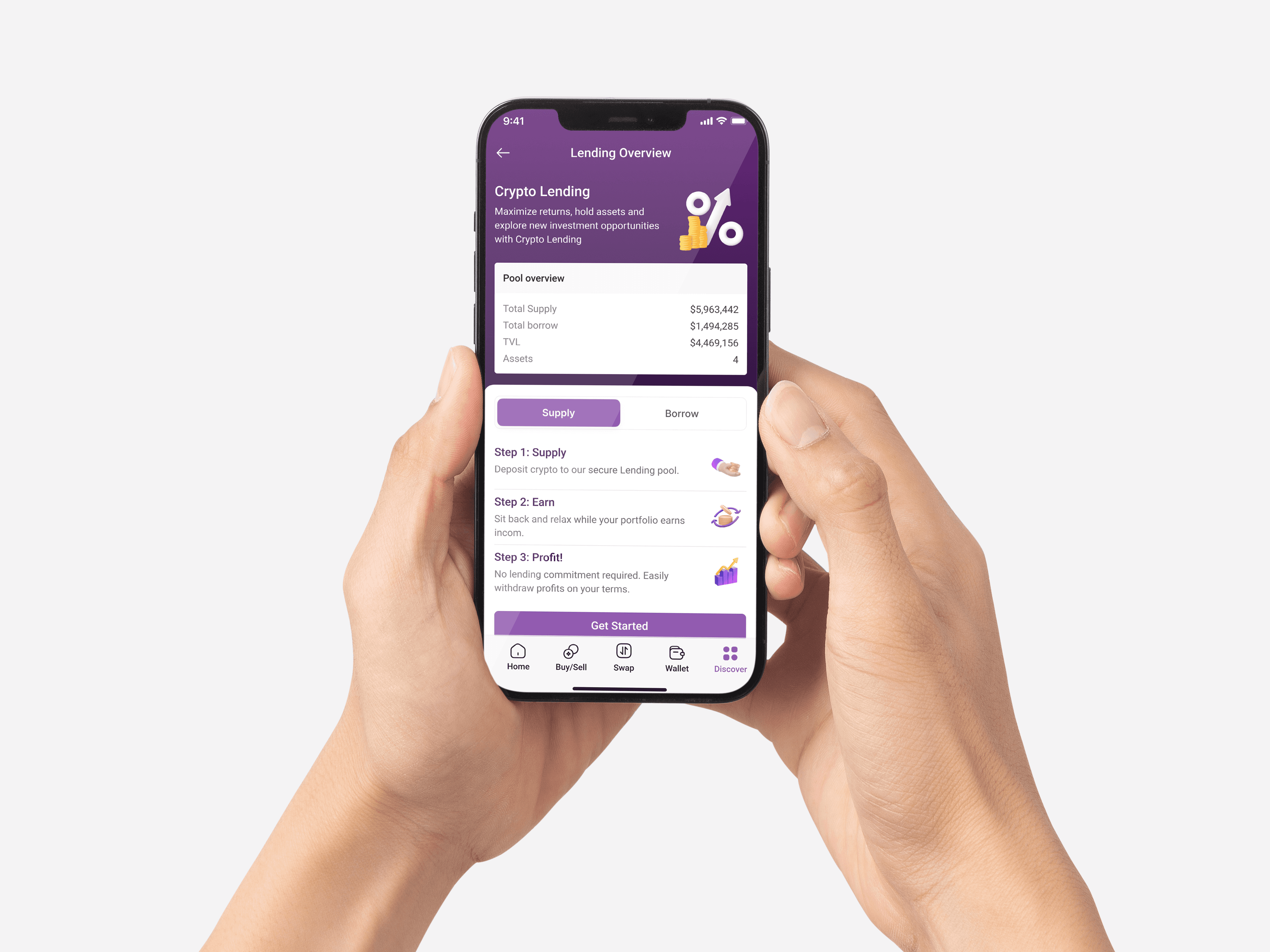

High-Fidelity Wireframes

Final designs showcasing:

Step-by-step onboarding process.

Simplified savings dashboard for non-tech users.

Advanced analytics panel for high-tech users.

Usability Testing

Tasks:

1. For Non-Tech Users:

Complete the onboarding tutorial.

Deposit $100 into a crypto savings account.

2. For High-Tech Users:

Review pool liquidity analytics.

Set up a recurring deposit schedule.

Key Insights:

Non-Tech Users: Found the guided onboarding intuitive and were more confident about making their first deposit.

High-Tech Users: Appreciated the advanced features but suggested adding more detailed customization options.

6. Results

Impact Metrics

50% Reduction in User Drop-Off: Guided onboarding reduced friction for non-tech users.

35% Increase in Deposits: Trust-building features like real-time pool updates encouraged more deposits.

20% Boost in Retention: Flexibility in withdrawals and custom options kept users engaged.

40% Higher Engagement: Advanced analytics attracted high-tech users to explore more features.

7. Reflection

What Worked Well

Guided onboarding effectively addressed non-tech users’ knowledge gaps.

Advanced analytics met the expectations of high-tech users.

Lessons Learned

Tailored solutions for diverse user groups are essential for broad adoption.

Early testing with both user groups ensures balanced feature prioritization.